In today’s rapidly evolving technological landscape, understanding the financial trajectory of leading companies is crucial for investors, analysts, and tech enthusiasts alike. This blog delves into an in-depth analysis of the expected profit growth over the next five years for some of the most influential tech giants: Tesla, NVIDIA, Amazon, Netflix, Microsoft, Alphabet, and Apple. By exploring their current market positions, strategic initiatives, and industry trends, we aim to provide a comprehensive outlook on their future profitability.

Introduction

The tech sector has consistently been at the forefront of innovation, driving economic growth and transforming industries worldwide. As we look ahead to the next five years, these seven companies stand out as key players with significant potential for profit growth. Each company brings unique strengths and challenges that will shape their financial futures.

Why Profit Growth Matters

Profit growth is a critical metric for evaluating a company’s success and sustainability. It reflects not only the ability to generate revenue but also the efficiency of operations and the effectiveness of business strategies. For investors, understanding profit growth projections can inform decisions about where to allocate resources for maximum returns.

Company Profiles and Expected Profit Growth

Tesla: Revolutionizing the Automotive Industry

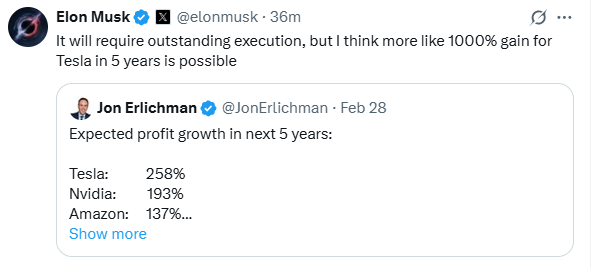

Expected Profit Growth: 258%

Tesla has redefined the automotive industry with its commitment to electric vehicles (EVs) and sustainable energy solutions. With increasing global demand for EVs and expanding production capabilities, Tesla is poised for substantial profit growth.

- Key Drivers : Expansion into new markets, advancements in battery technology, and diversification into energy storage and solar products.

- Challenges : Competition from established automakers and regulatory hurdles in various regions.

NVIDIA: Powering the Future of Computing

Expected Profit Growth: 193%

NVIDIA leads the charge in graphics processing units (GPUs) and AI computing, positioning itself at the heart of technological advancements across multiple sectors.

- Key Drivers : Growth in gaming, data centers, and AI applications. The acquisition of Arm could further bolster its position.

- Challenges : Intense competition in the semiconductor industry and potential antitrust issues with the Arm acquisition.

Amazon: E-commerce and Cloud Dominance

Expected Profit Growth: 137%

Amazon continues to dominate both e-commerce and cloud services, leveraging its vast ecosystem to drive profitability.

- Key Drivers : Expansion of AWS, international market penetration, and innovations in logistics and delivery.

- Challenges : Regulatory scrutiny over antitrust concerns and rising operational costs.

Netflix: Streaming Entertainment Leader

Expected Profit Growth: 128%

As a pioneer in streaming entertainment, Netflix aims to maintain its leadership through content innovation and global expansion.

- Key Drivers : Original content production, international subscriber growth, and diversification into gaming.

- Challenges : Increased competition from other streaming platforms and changing consumer preferences.

Microsoft: Versatility Across Platforms

Expected Profit Growth: 107%

Microsoft’s diverse portfolio, including software, hardware, and cloud services, ensures robust profit growth prospects.

- Key Drivers : Strength in Azure cloud services, Office 365 subscriptions, and gaming with Xbox.

- Challenges : Keeping pace with technological changes and addressing privacy concerns.

Alphabet: Expanding Beyond Search

Expected Profit Growth: 76%

Alphabet, parent company of Google, seeks to expand its reach beyond search engines into new technologies and services.

- Key Drivers : Ad revenue growth, YouTube monetization, and investments in AI and autonomous vehicles.

- Challenges : Regulatory pressures and maintaining user trust amidst data privacy concerns.

Apple: Innovation in Consumer Technology

Expected Profit Growth: 45%

Apple remains a powerhouse in consumer electronics, focusing on premium products and services.

- Key Drivers : iPhone sales, subscription services like Apple Music and iCloud, and health-related innovations.

- Challenges : Supply chain disruptions and saturation in mature markets.

Strategic Initiatives and Market Trends

Each company is pursuing strategic initiatives that align with broader market trends, ensuring sustained growth and competitiveness.

Technological Advancements

Innovation is the lifeblood of these tech giants. From AI and machine learning to quantum computing and IoT, they are investing heavily in cutting-edge technologies to enhance their offerings and create new revenue streams.

Sustainability and Corporate Responsibility

Increasingly, consumers and investors prioritize companies that demonstrate environmental and social responsibility. Many of these firms are integrating sustainable practices into their operations, which not only boosts their brand image but also opens up opportunities in green markets.

Global Expansion and Diversification

Expanding into emerging markets and diversifying product portfolios are common strategies among these companies. By tapping into underserved regions and developing complementary products, they aim to mitigate risks associated with reliance on single markets or products.

Challenges and Risks

Despite their promising outlooks, these companies face numerous challenges that could impact their profit growth trajectories.

Regulatory Scrutiny

Antitrust investigations and data privacy regulations pose significant threats to these tech giants. Compliance costs and potential penalties could erode profit margins if not managed effectively.

Economic Uncertainty

Global economic conditions, including inflation, interest rates, and geopolitical tensions, introduce volatility that could affect consumer spending and business investments.

Technological Disruptions

Rapid technological changes require continuous adaptation. Failure to innovate or respond swiftly to market shifts could jeopardize market share and profitability.

Conclusion

The next five years promise exciting developments for Tesla, NVIDIA, Amazon, Netflix, Microsoft, Alphabet, and Apple. While each company faces distinct challenges, their strong foundations, innovative cultures, and strategic foresight position them well for substantial profit growth. Investors and stakeholders should closely monitor these trends and adapt their strategies accordingly to capitalize on the opportunities presented by these dynamic enterprises.